Before I retired from the staff of The National Archives in 2010 and became a volunteer, I worked on cataloguing. Part of my work involved cataloguing hearth tax exemption certificates. The hearth tax lasted from 1662 to 1689, and its records are mainly in series E 179 at The National Archives.

Background: the tax

The hearth tax was intended as a permanent levy to supplement traditional taxes, to provide King Charles II and his successors with a reliable source of income. It was also known as ‘chimney money’, and was a twice-yearly charge of one shilling on every fireplace, hearth and stove in each dwelling in England and Wales, payable at Michaelmas (29 September) and Lady Day (25 March).

It became law in May 1662 and the first installment due was for the half year ended Michaelmas 1662. The tax was paid by the occupier of the house, not the landlord. It was resented, because after July 1663 the local constable was empowered to enter houses to verify the numbers of hearths. The law was abolished on William and Mary’s accession and replaced with the window tax.

Certain exemptions were allowed for:

- People who were too poor to pay church or poor rate.

- People inhabiting a house worth not more than 20 shillings a year and not having any other property worth 20 shillings a year, nor an annual income of ten pounds. They had to be exempted by a certificate signed by the minister and at least one of the churchwardens or overseers of the poor of their parish, and certified by two justices of the peace.

- Industrial hearths, private ovens and charitable institutions such as hospitals, almshouses and free schools. The exempt probably represented about a third of all heads of households in a parish, and in urban areas a higher proportion.

Because initial receipts were disappointing, by an Act of July 1663 parish constables were instructed to record both ‘chargeable’ and ‘not chargeable’ heads of households, so that both payers and exempt were listed on the returns. Another Act of 1664 ensured that, from Michaelmas 1664, landlords of exempt occupiers were liable to pay the tax, as was anyone with more than two hearths.

Value of the returns

When a hearth tax return is complete for any place, it provides an excellent list of heads of households and the number of hearths in their dwellings. The returns give the best overview of the country prior to the 1841 census, and are indispensable to local, economic and family historians. Many returns have been published. But a word of warning: the very poorest people (those receiving alms, or weekly parish relief) may not have been included in some lists of exemptions, although they should have been.

The records

Returns exist in The National Archives, but only for the periods when the returns had to be audited in the Exchequer: Michaelmas 1662 to Lady Day 1666, and Michaelmas 1669 to Lady Day 1674. At other times the tax was farmed out or put in commission, and those records do not survive. The returns at The National Archives are in series E 179, and consist of lists of names enrolled on parchment by clerks in the counties, complemented by exemption certificates drawn up by parish officials.

The National Archives’ records for each county would ideally consist of nine complete returns, but this is almost never the case. Some counties are well represented, some poorly. One reason for this was negligent storage, particularly in the period 1822–1833. During one of the frequent moves of documents, ‘large quantities of parchment were purloined by the labourers employed and sold to glue manufacturers’.

The exemption certificates

The hearth tax exemption certificates were an under-used and largely unrecognised source until the publication in 2001 of P Seaman, ‘Norfolk Hearth Tax Exemption Certificates 1670-1674: Norwich, Great Yarmouth, King’s Lynn and Thetford’ (British Record Society, volume 117 (Hearth Tax Series vol. III) and Norfolk Record Society, volume 65), which sought to bring them to the attention of a wider audience.

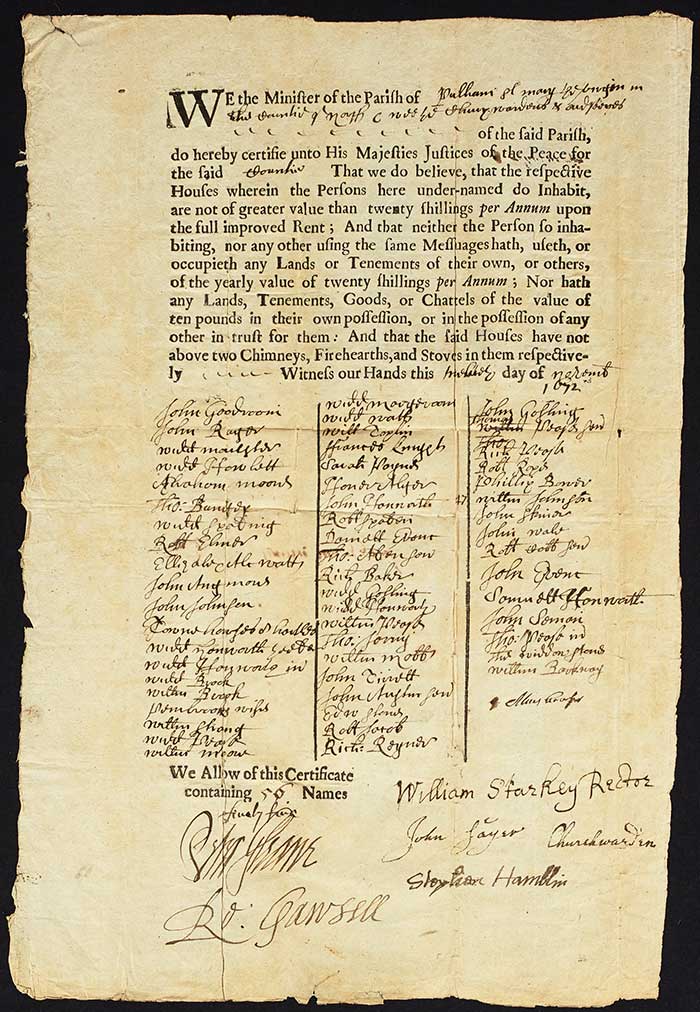

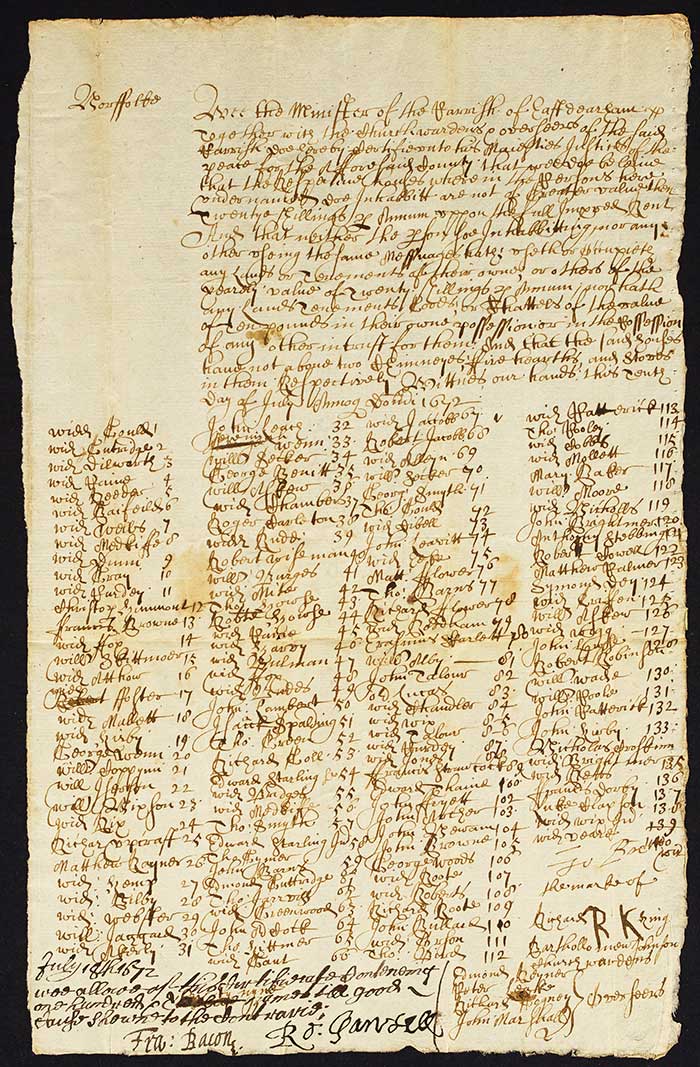

Each certificate represents a parish and was drawn up by the overseers of the poor, churchwardens and minister of the parish. Printed ‘pro forma’ certificates were introduced in 1670, and measure 30.5 cm long by 19.5 cm wide. They recite the statutory provisions for exemption, and when the names of the exempt had been added they were signed by the minister, churchwardens and overseers. The completed certificates were then submitted to two justices of the peace for signature.

A printed certificate for the parish of Pulham St Mary, Norfolk. Catalogue reference: E 179/337 f. 138

A manuscript certificate for the market town of East Dereham, Norfolk, catalogue reference: E 179/337 f. 368. Manuscript certificates were written when the supply of printed certificates had run out or when there were too many names to fit into the printed ‘pro forma’ certificate.

The certificates might be folded small and tied in bundles, or rolled up in bundles, and put into hessian bags or leather pouches. The certificates were ‘particulars of account’ in support of the parchment returns, and the bags were labelled ‘bags of particulars’ and sent with the returns to the Exchequer.

Some certificates are sewn together at the head, or have been bound in guard books, or have been given modern stamped numbers. Such certificates have not been considered suitable for my project as they cannot be rearranged and may already have been listed in detail on the E 179 Database.

My project

Working as a volunteer since 2010, I have chosen counties whose certificates are mainly loose and can be sorted. My method for each county has been to sort the certificates into administrative hundreds, arranged alphabetically; then within each hundred into parishes, arranged alphabetically; and within each parish I have listed the certificates chronologically. For each certificate, the information I have given is:

- name of hundred

- name of parish

- number of personal names

- number of hearths

- date

The counties I’ve listed so far are as follows:

| County | Document reference | Certificates |

|---|---|---|

| Bedfordshire | E 179/324 | 171 certs |

| Berkshire | E 179/76/464 | 204 certs |

| Buckinghamshire | E 179/80/362 | 525 certs |

| Dorset | E 179/105/352 | 488 certs |

| Essex | E 179/328 | 805 certs |

| Herefordshire | E 179/119/509 | 225 docs |

| Hertfordshire | E 179/121/349 | 314 certs |

| Huntingdonshire | E 179/122/231 | 175 certs |

| London | E 179/143/367 | 37 certs |

| Middlesex | E 179/143/367 | 144 certs |

| Norfolk | E 179/335-338 | 2,592 certs |

| Oxfordshire | E 179/164/536 | 97 docs |

| Staffordshire | E 179/344 | 856 certs |

| Suffolk | E 179/345 | 582 certs |

| Surrey | E 179/346 | 316 certs |

| Sussex | E 179/191/424 | 97 docs |

| Warwickshire | E 179/347 | 799 certs |

| Wiltshire | E 179/348 | 645 certs |

| Anglesey | E 179/351/1 | 113 certs |

| Caernarfonshire | E 179/351/2 | 137 certs |

The details of all these series can be found in The National Archives catalogue ‘Discovery’. The E 179 Database is no longer being updated, and The National Archives is working on a solution that we hope will allow the data to be incorporated into Discovery.

The Hearth Tax exemption certificates for Buckinghamshire, along with the fragmentary Hearth Tax rolls, have been very helpful in providing clues on my direct paternal line. This information, along with small pieces of evidence from manorial court rolls; have helped me gather together tiny breadcrumbs that help document the family. While I still have a lot to work out, including how some people relate to others, each small piece of evidence has started to build up a better picture. I now know much more about my direct paternal line in the 1640’s to 1700’s where parish records are not clear or extant.

Extraordinary .Never heard of this hearth tax- well I don’t think so .How mean as a way of raising tax ?I

I should think that a shilling was quite a lot of money in those times .

BTW Just watched colour film on My 5 on my iPad of WW2 about our troops in North Africa and Malta and Italy.( and of course German and Italian troops .Brings it to life being in colour .Interesting hearing all those place names in the film that my Dad -John Thomas Beale- who was in the Navy -mentioned .It occurs to me that many films like documentaries etc made about those times are usually based around the role of the Army and the RAF in the fight but the naval boats played a significant role in the troop landings in those places.He was actually on HMS Hood for 5 years and left her 3 weeks before she was sunk.

Hearth Tax on Military establishments

Hurst Castle lies within the parish of Hordle and is at the end of a sand spit over a mile from the mainland guarding the western entrance to the Solent. It certainly had hearths so that the soldiers could cook etc. Some soldiers and their families lived outside the walls of the castle. Would Hearth Tax have been levied on the castle (left pocket – right pocket) and would the houses etc just outside the walls but occupied by soldiers have been charged?